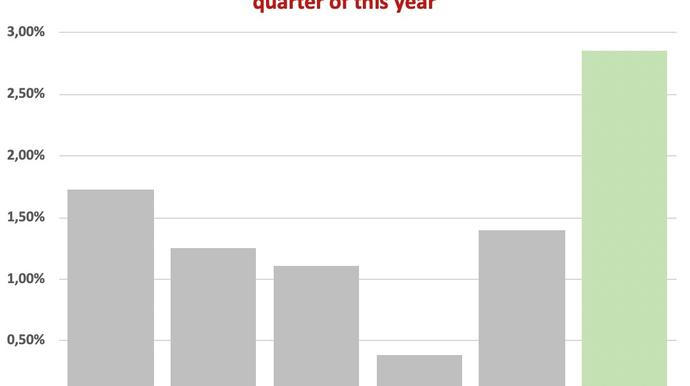

NOVA Green Energy fund has experienced the best quarter in its seven-year existence. Despite all the crises of 2020. The coronavirus crisis has hit the world economy and thus financial markets.

What factors have influenced the success of NOVA Green Energy fund and what kind of development may be expected throughout the year, fund manager Ondřej Žídek reveals.

What positively affected the performance of NOVA Green Energy fund and what should be expected throughout the year 2020?

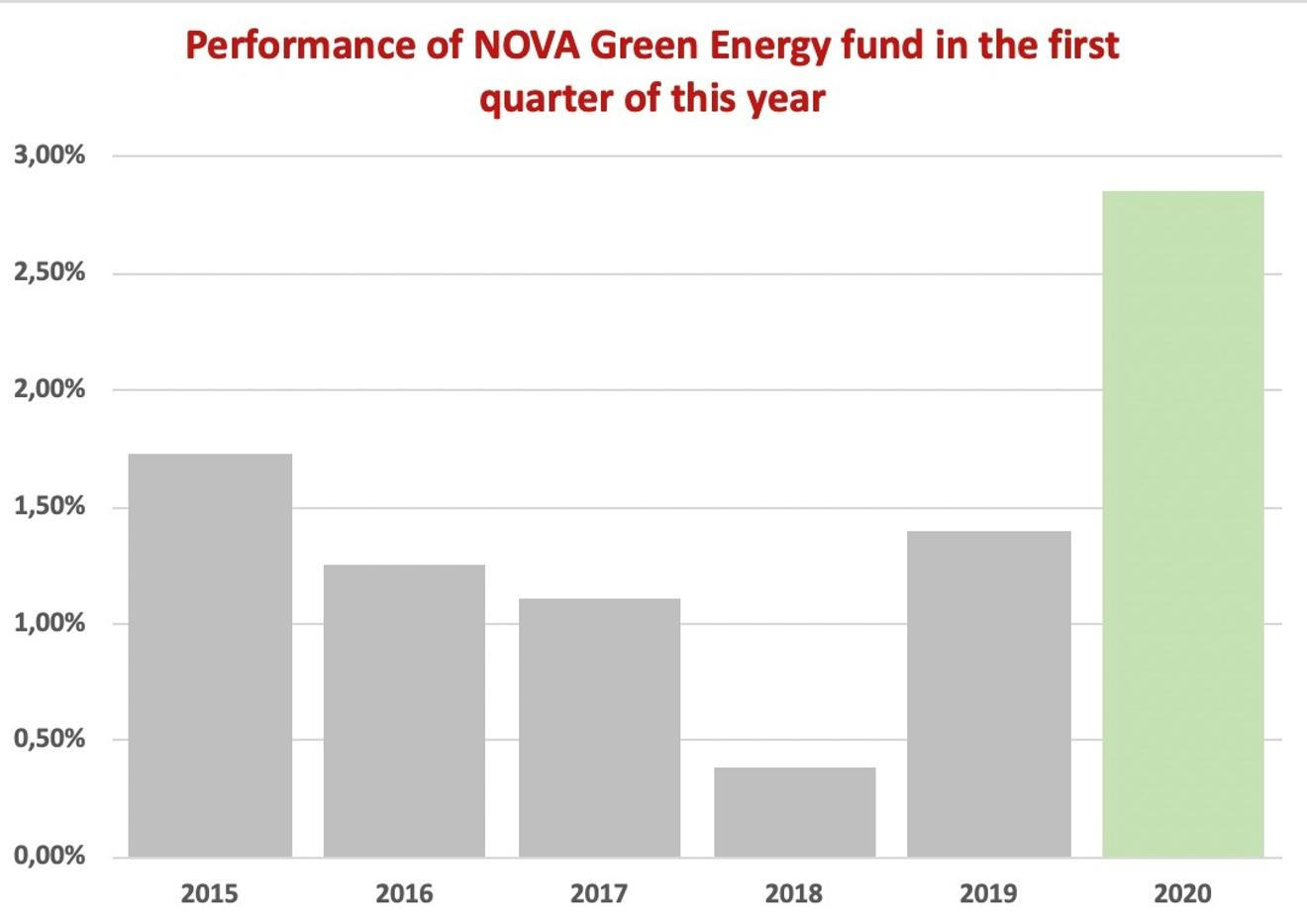

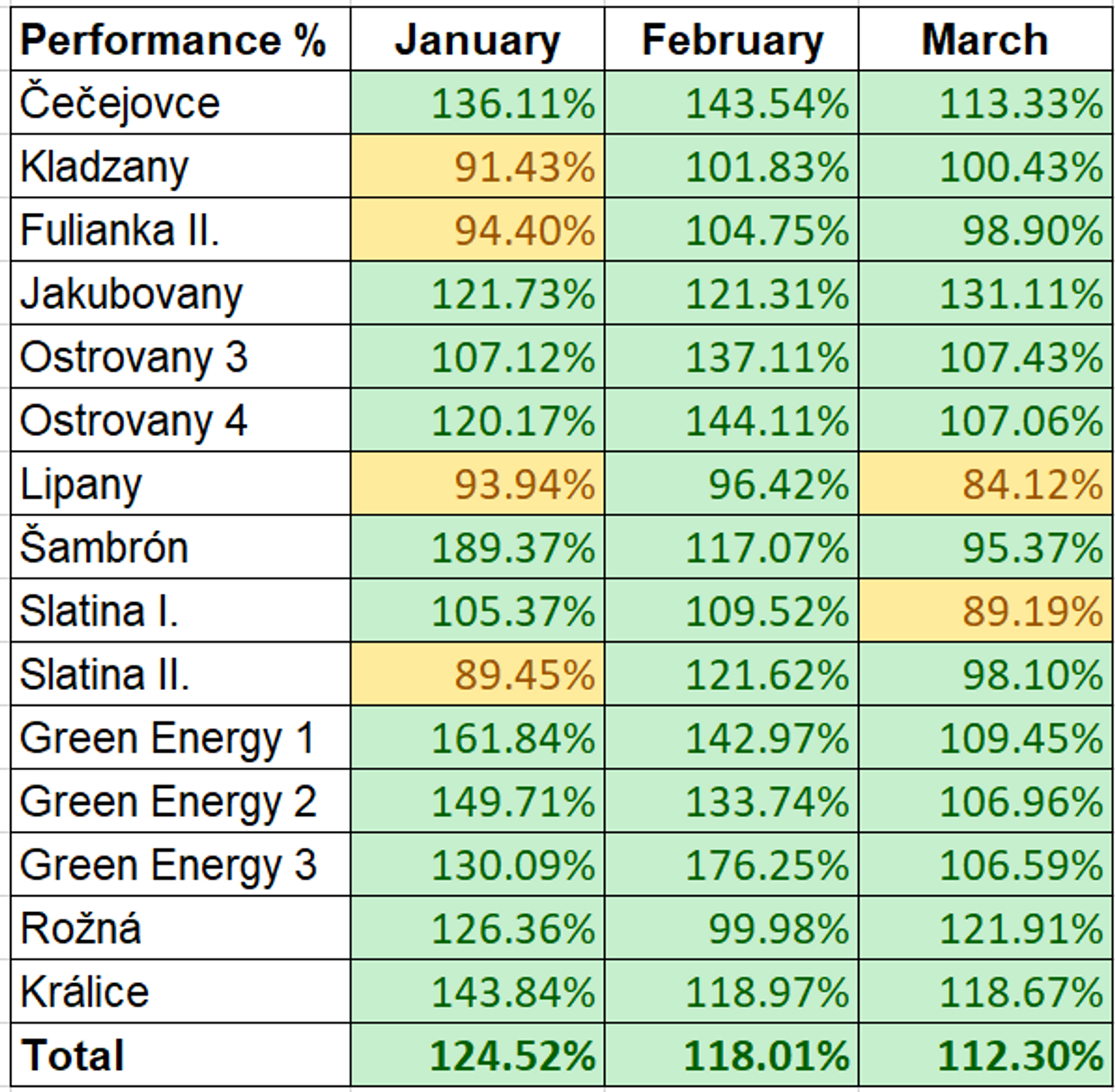

The beginning of this year was rocket due to several factors. The first one is undoubtedly the higher exposure to light, i.e. the number of sunny days, which this year was much greater compared to other years. Thanks to the nice weather, the Fund's revenues in the first quarter exceeded the original forecasts by EUR 200,000. Total exposure to light was approximately 15 percent higher than expected in our production plans.

What other factors positively contributed to the Fund´s performance?

Since autumn we have been using cheaper feedstock in biogas stations, namely sugar beet pulp, which contributed to the positive results. We normally use commercially available maize silage grown specifically for this purpose. On the other hand, sugar beet pulp is a waste material, and therefore is far cheaper.

In practice, the beets used for sugar production are cleaned and cut into thin strips, from which sugar is extracted. The strips, however, still contain enough substance required for chemical reactions in biogas production. For a sugar refinery, it is basically a waste commodity that would no longer be used. For biogas plants, though it is a valuable and rich raw material. Sugar beet processing into sugar usually takes place in autumn and therefore we have lower costs of feedstock in biogas plants during winter.

Another factor for the successful beginning of 2020 is the fact, that in the last quarter of the previous year we managed to technically optimize the biomass heating plant in Krnča. Thanks to these new modifications, the plant's potential has increased at current costs and raw material consumption.

The last factor is the depreciation of Czech Koruna to Euro. This has brought us an additional yield of 0.55%. In March, therefore, Fund's assets earned an extra 0.8% due to the aforementioned factors, plus another 0.55% due to the depreciation of Czech Koruna. We are now taking further measures to maintain this surplus even when the exchange rate stabilizes.

In March, we also completed an acquisition of a photovoltaic power plant in Bárcs, Hungary. Assets under management of NOVA Green Energy have finally exceeded EUR 100 million. What are the next acquisition targets for this year?

We are currently working on the acquisition of two biomass heating plants on the Slovak market. These are Bardějov and Topoľčany. They are also the two largest biomass sources in Slovakia. Both sources have an electrical output of 8 MW, furthermore, Bardějov has a thermal output of 25 MW and Topoľčany even 28 MW. In addition to the electricity supplied via the grid, both power plants also provide heat for cities.

Moreover, during the year 2020, we intend to build a second photovoltaic power plant in Hungary, which will be twice as big as Bárcs. The planned installed capacity is set at around 30 MW. The construction should be finished by the end of this year and we are going to put the power plant into operation at the turn of the year 2020/2021.

We are also working on other projects in collaboration with our sister NOVA Real Estate fund. We intend to build a 5 MW photovoltaic power plant on a rooftop of their industrial park in Trenčín.

Are there any risk factors that could reverse the positive performance of the Fund throughout the year 2020 and negatively affect it?

At the moment, I cannot imagine any significant risk factor that could negatively affect the performance of NOVA Green Energy. The advantage of the Fund is that it is not dependant on financial or capital market development. Therefore, the decline in shares due to the crisis that has now occurred does not affect NOVA Green Energy. The Fund consists almost 100% of tangible assets that have guaranteed feed-in tariffs for 15 to 25 years. Thus, they are not affected by the coronavirus pandemic.

Furthermore, NOVA Green Energy is well structured and diversified, incorporating multiple technologies in several countries. The exchange rate fluctuation though, especially between Czech Koruna and Euro, may slightly affect us. This could, therefore, affect the performance of the Fund. However, we expect that as Czech Koruna weakened from CZK 25 to CZK 27, it would gradually strengthen again and decrease to the original CZK 25. This also eliminates the effect of exchange rate risk.

That is why we do not expect any dramatic decline or extremely high performance at the moment. Everything is going according to the plan and our goal to surpass 6% performance this year is more than realistic. If we keep the bar of the first quarter, we could boldly reach the record yield of 2015, which was 8.25%.