NOVA Real Estate

NOVA Real EstateCommercial real estate represents a typical diversification tool for any investment portfolio. Commercial properties in lucrative locations offer attractive value preservation and stable return for a conservative investor. Sub-fund 1 invests only in prime commercial properties. Its focus on the quality of tenants, attractive locations with enhancement potential and real estate meeting the highest requirements for quality and technical standards are the main aspects of the fund investment policy and its value proposition to investors.

NOVA Real Estate - Subfund 1 does not currently hold any real estate and is phasing out its operations.

Audited net appreciation

Carefully chosen assets—the investment company selects only prime assets. Every transaction goes through multiple due diligence levels with a focus on eliminating potential risks. The main aspects for selection are yield, location and the possibility of generating additional value with active property management.

Inflation protection—as the market standard, lease agreements are indexed against inflation. If inflation rises, rental income rises as well.

Diversification—the investment company selects primarily assets across the whole Czech Republic with a mixture of shopping centres, retail markets and office buildings to minimize the economic cycle’s effect.

Value drivers—assets are selected with a focus on three main drivers that influence their value—rental income, yield expectation and the possibility of further development of the project.

Lokální obchodní centrum Orlice Park v Hradci Králové je v majetku fondu NOVA Real Estate od roku 2015 a prošlo významnou revitalizací v roce 2014, která mu dává nadčasový a svěží design.

Naše fondy zaznamenaly i v prosinci pozitivní výsledek.

Pro naši největší budovu, logistický a průmyslový areál v Trenčíně, se podařilo prodloužit nájemní smlouvu s největším nájemcem (téměř 20 % plochy) až do roku 2028.

Investing in the Sub-fund is designed for both private investors and institutional ones who are willing to accept a long-term investment horizon. That is why an investor should consider his/her liquidity needs even if investments in the Sub-fund may be liquidated.

The minimum amount, under Section 272 ZISIF1, that an investor can invest is EUR 125,000, or CZK 1,000,000 (equivalent of EUR 40,000) after performing a suitability test under Section 15 ZKPT2.

How to Invest

Individual Investors

Investments in the Sub-fund are exclusively intended for persons matching the definition of a qualified investor in compliance with Act No. 240/2013 Coll., on Investment Companies and Investment Funds, so it is necessary to invest at least EUR 125,000 or CZK 1,000,000 (equivalent of EUR 40,000) after performing a suitability test and signing a Declaration of Risk Awareness concerning this type of investment and including investment experience.

Subsequently, investors wishing to make investments fill out the following documents with the fund manager:

+ Agreement on Subscription/Redemption of Investment Shares

+ Request for Issuance of Investment Shares

+ Declaration of Risk Awareness

+ Anti-Money Laundering (AML) Form

+ FATCA documents

Institutional Investors, asset managers and similar financial institutions

You will need to fill out a few subscription documents:

We will need hard copies of these documents from you by mail. To accelerate the process, please send us scanned copies by e-mail while the hard copies are delivered to us.

An investor can subscribe investment shares for the actual NAV (Net Asset Value). Every investor must fulfil the conditions under Section 272 ZISIF1—qualified investor—minimum invested capital, risk awareness statement, etc.

Every investor has a right to investment shares in the Sub-fund at the current value. This type of open-ended fund structure provides an investor with great variability in terms of liquidity needs. With the investment company’s permission, an investor can sell the investment shares to a third-party as well.

*Basic data about NOVA Real Estate - Sub-fund 1*

| Fund type | Investment fund with variable registered capital |

| Sub-fund | NOVA Real Estate – Sub-fund 1 |

| Investment objective | Real estate investments |

| Investment strategy | The Sub-fund is aimed at the premium type of real estate – business centres, office buildings and other investment opportunities related to the real property market. |

| Equity capital | 112 757 thous. EUR (as of 31th July 2020) |

| Issued security | Registered investment shares |

| Fund Duration | From 20 August 2015 for an indefinite period of time |

| Currency | CZK |

| Minimum investment | Minimum initial investment for every single investor of the Sub-fund amounts to EUR 125,000 or CZK 1,000,000 (equivalent 40,000 EUR) after performing a suitability test under Section 15 ZPKT2 |

| Fund Manager | REDSIDE Fund Management |

| Management fee | 1,6 % of sub-fund’s NAV, min. 300,000 CZK/month |

| Performance fee | 30 % of annual yield of sub-fund over 6% evaluation of the fund |

| Depository | UniCredit Bank Czech Republic and Slovakia |

| Auditor | PricewaterhouseCoopers Audit, s.r.o. |

| Supervisory Authority | Czech National Bank |

| Law and accounting system | The Czech Republic |

| Fund taxation | 5 % from profit |

With regard to the possible unforeseen fluctuations on real estate markets there could be fluctuations in the value of assets in the Subfund, increases and decreases of such value. In addition, an outage of planned income from renting real estate could lead to a reduction in the value of investment shares, due to lower net income. If it is a longer-term outage of rental income, this fact is reflected in a reduction in the value of the relevant real estate. With regard to the character of the real estate that comprise the fundamental part of the fund’s assets, it is necessary to draw attention to the fact that the liquidation of the real estate with an attempt to achieve the best price is demanding in time terms. In the event it is necessary to sell the real estate assets in a short period of time, there is a risk the expected price will not be achieved. The credit risk could consist, in particular, of entities that have payment obligations to the Subfund (e.g. the tenants of properties, debtors under investment instruments, etc.) not paying their liabilities. An outage of planned rental income could occur at random, where it affects more important property tenants, or it could be related to the overall situation on the market, for example in the case of an economic recession, and in this case it influences the behaviour of a larger quantity of tenants or potential tenants. Some of the real estate in the fund’s portfolio and also some of the rentals resulting from the real estate in the fund’s portfolio are booked in CZK. The fund’s total performance can therefore be influenced also by trends in the EUR/CZK exchange rate. The return on the investment is not hedged.

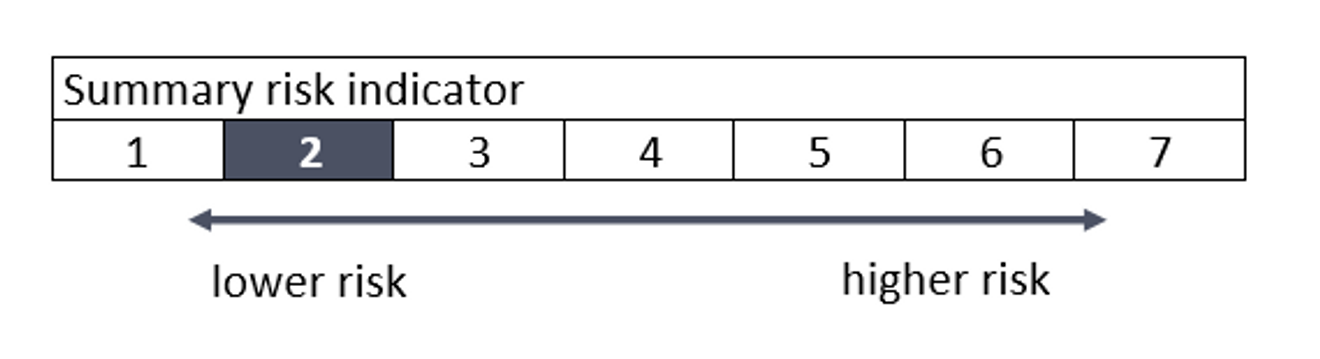

To determine the total risk indicator, we used available data of comparable investment funds on the Czech market.

The first refinanced acquisition for the real estate portfolio, consisting of three shopping centers located in the Czech Republic, occurred after April 2016. The Sub-fund has started generating returns for its investors.

In August 2016, the Sub-fund acquired four class A office buildings located in main office areas in Prague. The second acquisition helped portfolio diversification and mitigates economic cycles. There will be more acquisitions in the future.

| CZK | 0,7924 CZK |

| EUR | 3,9979 EUR |

Performance as of December 2025

| 1 month: | 0,11 % |

| 6 months: | 0,48 % |

| 1 year: | -3,95 % |

| YTD: | -3,95 % |

| Date | Investment Share value (EUR) | NAV (EUR) |

| 31.12.2025 | 3,9979 | 5 875 409 |

| 30.11.2025 | 3,9937 | 5 869 376 |

| 31.10.2025 | 3,9872 | 5 859 555 |

| 30.09.2025 | 3,9837 | 5 854 476 |

| 31.08.2025 | 3,9809 | 5 850 274 |

| 31.07.2025 | 3,9785 | 5 846 540 |

| 30.06.2025 | 3,9789 | 5 846 884 |

| 31.05.2025 | 3,9832 | 5 853 058 |

| 30.04.2025 | 3,9828 | 5 880 213 |

| 31.03.2025 | 3,9859 | 14 411 352 |

| 28.02.2025 | 3,9940 | 65 333 746 |

| 31.01.2025 | 4,1603 | 67 942 886 |

| 31.12.2024 | 4,1623 | 67 963 835 |

| 30.11.2024 | 6,9607 | 113 557 572 |

| 31.10.2024 | 6,9469 | 113 257 620 |

| 30.09.2024 | 6,9327 | 113 210 005 |

| 31.08.2024 | 6,9124 | 113 068 425 |

| 31.07.2024 | 6,8843 | 112 066 911 |

| 30.06.2024 | 6,8784 | 112 513 220 |

| 31.05.2024 | 6,8701 | 112 798 750 |

| 30.04.2024 | 6,8442 | 111 807 927 |

| 31.03.2024 | 6,8222 | 111 248 522 |

| 29.02.2024 | 6,7951 | 110 737 974 |

| 31.01.2024 | 6,7886 | 111 227 778 |

| 31.12.2023 | 6,7784 | 111 264 748 |

| 30.11.2023 | 7,4738 | 123 310 402 |

| 31.10.2023 | 7,4393 | 122 349 724 |

| 30.09.2023 | 7,3575 | 121 321 094 |

| 31.08.2023 | 7,3785 | 122 054 877 |

| 31.07.2023 | 7,3594 | 121 983 932 |

| 30.06.2023 | 7,3394 | 121 923 371 |

| 31.05.2023 | 7,3114 | 121 872 972 |

| 30.04.2023 | 7,2957 | 122 902 573 |

| 31.03.2023 | 7,2755 | 122 586 157 |

| 28.02.2023 | 7,2552 | 122 798 351 |

| 31.01.2023 | 7,2218 | 122 409 489 |

| 31.12.2022 | 7,1888 | 121 489 933 |

| 30.11.2022 | 7.0899 | 125 089 298 |

| 31.10.2022 | 7.0609 | 124 595 621 |

| 30.9.2022 | 7.0278 | 124 007 700 |

| 31.8.2022 | 6.9898 | 122 841 942 |

| 31.7.2022 | 6.9223 | 123 090 559 |

| 30.6.2022 | 6.8803 | 122 493 685 |

| 31.5.2022 | 6.8391 | 120 493 782 |

| 30.4.2022 | 6.8044 | 120 787 740 |

| 31.3.2022 | 6.7755 | 120 806 740 |

| 28.2.2022 | 6.7210 | 120 272 951 |

| 31.1.2022 | 6.6956 | 120 881 759 |

| 31.12.2021 | 6.6502 | 119 701 453 |

| 30.11.2021 | 6.5042 | 117 050 778 |

| 31.10.2021 | 6.4398 | 121 542 272 |

| 30.9.2021 | 6.3978 | 121 113 206 |

| 31.8.2021 | 6.3498 | 120 541 856 |

| 31.7.2021 | 6.3080 | 119 544 180 |

| 30.6.2021 | 6.2668 | 118 652 706 |

| 31.5.2021 | 6.2237 | 117 717 116 |

| 30.4.2021 | 6.1825 | 117 161 336 |

| 31.3.2021 | 6.1434 | 115 926 245 |

| 28.2.2021 | 6.1115 | 115 366 537 |

| 31.1.2021 | 6.0915 | 115 521 544 |

| 31.12.2020 | 6.0644 | 115 054 443 |

| 30.11.2020 | 5.9579 | 113 742 091 |

| 31.10.2020 | 5.8976 | 111 119 989 |

| 30.9.2020 | 5.8769 | 110 360 633 |

| 31.8.2020 | 5.8979 | 111 630 278 |

| 31.7.2020 | 5.8760 | 112 757 448 |

| 30.6.2020 | 5.8503 | 136 283 253 |

| 31.5.2020 | 5.8227 | 135 379 828 |

| 30.4.2020 | 5.7913 | 134 253 254 |

| 31.3.2020 | 5.7677 | 132 048 176 |

| 29.2.2020 | 5.7433 | 131 426 850 |

| 31.1.2020 | 5.7158 | 129 688 545 |

| 31.12.2019 | 5.6883 | 126 374 925 |

| 30.11.2019 | 5.6458 | 124 280 867 |

| 31.10.2019 | 5.6193 | 121 026 227 |

| 30.9.2019 | 5.5843 | 119 384 438 |

| 31.8.2019 | 5.5546 | 117 785 561 |

| 31.7.2019 | 5.5314 | 115 975 866 |

| 30.6.2019 | 5.5108 | 114 826 482 |

| 31.5.2019 | 5.5204 | 112 722 741 |

| 30.4.2019 | 5,4946 | 107 769 166 |

| 31.3.2019 | 5.4578 | 106 789 132 |

| 28.2.2019 | 5.4458 | 106 490 312 |

| 31.1.2019 | 5,4181 | 105 389 524 |

| 31.12.2018 | 5,4084 | 96 166 323 |

| 30.11.2018 | 5,3572 | 94 639 498 |

| 31.10.2018 | 5,3154 | 93 842 052 |

| 30.9.2018 | 5,2938 | 93 552 326 |

| 31.8.2018 | 5,2720 | 93 018 468 |

| 31.7.2018 | 5,2535 | 92 602 686 |

| 30.6.2018 | 5,2045 | 79 909 095 |

| 31.5.2018 | 5,1798 | 79 444 830 |

| 30.4.2018 | 5,1577 | 78 878 961 |

| 31.3.2018 | 5,1201 | 78 267 395 |

| 28.2.2018 | 5,0815 | 77 510 357 |

| 31.1.2018 | 5,0441 | 76 354 454 |

| 31.12.2017 | 4,9778 | 75 351 743 |

| 30.11.2017 | 4,9252 | 47 833 252 |

| 31.10.2017 | 4,9203 | 47 786 031 |

| 30.9.2017 | 4,9001 | 47 589 478 |

| 31.8..2017 | 4,8866 | 47 459 056 |

| 31.7.2017 | 4,8782 | 47 377 275 |

| 30.6.2017 | 4,8647 | 47 245 661 |

| 31.5.2017 | 4,8478 | 47 081 775 |

| 30.4.2017 | 4,8247* | 46 656 086* |

| 31.3.2017 | 4,7581 | 46 011 407 |

| 28.2.2017 | 4,7477 | 45 910 902 |

| 31.1.2017 | 4,7385 | 45 821 857 |

| 31.01.2025 | 4,1603 | 67 942 886 |

(*) End-of-year revaluation taken into account.

| Date | Investment Share value (CZK) | NAV (CZK) |

| 31.12.2025 | 0,7924 | 142 449 297 |

| 30.11.2025 | 0,7916 | 141 862 806 |

| 31.10.2025 | 0,7903 | 142 592 271 |

| 30.09.2025 | 0,7896 | 142 497 943 |

| 31.08.2025 | 0,7890 | 143 009 953 |

| 31.07.2025 | 0,7885 | 143 649 483 |

| 30.06.2025 | 0,7886 | 144 710 385 |

| 31.05.2025 | 0,7895 | 145 916 738 |

| 30.04.2025 | 0,7894 | 146 593 705 |

| 31.03.2025 | 0,7900 | 359 779 393 |

| 28.02.2025 | 0,7916 | 1 634 977 006 |

| 31.01.2025 | 0,8246 | 1 710 122 438 |

| 31.12.2024 | 0,8250 | 1 711 669 176 |

| 30.11.2024 | 1,3797 | 2 869 032 064 |

| 31.10.2024 | 1,3770 | 2 868 249 228 |

| 30.09.2024 | 1,3742 | 2 850 627 925 |

| 31.08.2024 | 1,3702 | 2 830 102 677 |

| 31.07.2024 | 1,3646 | 2 853 223 552 |

| 30.06.2024 | 1,3634 | 2 816 205 898 |

| 31.05.2024 | 1,3618 | 2 786 693 121 |

| 30.04.2024 | 1,3567 | 2 811 410 323 |

| 31.03.2024 | 1,3523 | 2 815 143 842 |

| 29.02.2024 | 1,3469 | 2 808 315 024 |

| 31.01.2024 | 1,3456 | 2 767 903 265 |

| 31.12.2023 | 1,3436 | 2 751 020 887 |

| 30.11.2023 | 1,4814 | 2 995 209 670 |

| 31.10.2023 | 1,4746 | 3 004 909 221 |

| 30.09.2023 | 1.4584 | 2 952 955 419 |

| 31.08.2023 | 1.4626 | 2 938 471 175 |

| 31.07.2023 | 1.4588 | 2 916 635 814 |

| 30.06.2023 | 1.4548 | 2 893 241 592 |

| 31.05.2023 | 1.4492 | 2 893 873 731 |

| 30.04.2023 | 1.4461 | 2 888 824 971 |

| 31.03.2023 | 1.4421 | 2 879 548 838 |

| 28.02.2023 | 1.4381 | 2 885 147 252 |

| 31.01.2023 | 1.4315 | 2 912 121 738 |

| 31.12.2022 | 1.4250 | 2 929 729 727 |

| 30.11.2022 | 1.4054 | 3 044 673 521 |

| 31.10.2022 | 1.3997 | 3 050 723 790 |

| 30.9.2022 | 1.3931 | 3 044 389 035 |

| 31.8.2022 | 1.3856 | 3 015 155 473 |

| 31.7.2022 | 1.3722 | 3 029 258 663 |

| 30.6.2022 | 1.3639 | 3 030 493 760 |

| 31.5.2022 | 1.3557 | 2 977 401 361 |

| 30.4.2022 | 1.3488 | 2 971 982 339 |

| 31.3.2022 | 1.3431 | 2 945 872 347 |

| 28.2.2022 | 1.3323 | 3 006 222 417 |

| 31.1.2022 | 1.3273 | 2 945 284 056 |

| 31.12.2021 | 1.3183 | 2 975 778 114 |

| 30.11.2021 | 1.2894 | 2 987 721 105 |

| 31.10.2021 | 1.2766 | 3 123 028 685 |

| 30.9.2021 | 1.2683 | 3 087 781 178 |

| 31.8.2021 | 1.2588 | 3 076 830 870 |

| 31.7.2021 | 1.2505 | 3 048 376 588 |

| 30.6.2021 | 1.2423 | 3 023 864 223 |

| 31.5.2021 | 1,2338 | 2 995 900 603 |

| 30.4.2021 | 1,2256 | 3 032 721 177 |

| 31.3.2021 | 1.2178 | 3 030 891 678 |

| 28.2.2021 | 1.2115 | 3 022 026 425 |

| 31.1.2021 | 1.2075 | 3 005 870 567 |

| 31.12.2020 | 1.2021 | 3 019 603 869 |

| 30.11.2020 | 1.1810 | 2 978 905 373 |

| 31.10.2020 | 1.1690 | 3 028 019 687 |

| 30.9.2020 | 1.1649 | 3 002 912 827 |

| 31.8.2020 | 1.1691 | 2 925 829 584 |

| 31.7.2020 | 1.1648 | 2 951 426 194 |

| 30.6.2020 | 1.1597 | 3 364 214 180 |

| 31.5.2020 | 1.1542 | 3 643 748 066 |

| 30.4.2020 | 1.1480 | 3 637 591 927 |

| 31.3.2020 | 1.1433 | 3 608 216 419 |

| 29.2.2020 | 1.1385 | 3 336 927 714 |

| 31.1.2020 | 1.1331 | 3 269 448 229 |

| 31.12.2019 | 1.1277 | 3 211 186 838 |

| 30.11.2019 | 1.1193 | 3 171 026 316 |

| 31.10.2019 | 1.1140 | 3 087 379 062 |

| 30.9.2019 | 1.1071 | 3 081 909 262 |

| 31.8.2019 | 1.1012 | 3 052 412 804 |

| 31.7.2019 | 1.0966 | 2 975 940 724 |

| 30.6.2019 | 1.0925 | 2 921 759 828 |

| 31.5.2019 | 1.0944 | 2 910 163 013 |

| 30.4.2019 | 1,0893 | 2 765 356 795 |

| 31.3.2019 | 1.0820 | 2 755 159 604 |

| 28.2.2019 | 1.0796 | 2 726 151 984 |

| 31.1.2019 | 1,0741 | 2 714 834 151 |

| 31.01.2025 | 0,8246 | 1 710 122 438 |

(*) End-of-year revaluation taken into account.

Fund Manager (Real Estate)

Pavel Kadera

Asset Manager (Real Estate)

Jan Mathy

The Fund is governed pursuant to Act No. 240/2013 Coll., on Investment Companies and Investment Funds, and Act No. 256/2004 Coll., on Business Activities on the Capital Market. Compliance with legislation and particular statutes is supervised by the Czech National Bank.

All investments are overseen by the Fund’s Investment Committee. In addition, the Fund is regulated by the Czech National Bank and the investments are under constant supervision of the financing banks.

Supervision: Czech National Bank (CNB) The fund manager provides a monthly report to the CNB on the fund’s asset structure, including accounts.

Manager: REDSIDE Fund Management It was granted a licence by the CNB to perform management and administration of investment funds. The size of the assets managed exceeded EUR 200 million in 2016.

Depository: UniCredit bank Czech Republic and Slovakia, a.s. It monitors, performs and reports money transactions in compliance with the law and the fund’s statute.

Auditor: PricewaterhouseCoopers Audit, s.r.o. It audits the financial statements and fund’s annual report once a year.

Asset Valuation Officer: from the CNB list Revaluation of the fund is carried out by an Asset Valuation Officer from the CNB list independent of the investment company at least once a year.

Yes. You must however make sure and confirm to Redside that the ultimate buyer is aware that Nova Real Estate fund is a fund for qualified investors, i.e. governed by a specific law and with the minimum investment threshold as set out by the law. Investors must in compliance with Czech legislation fill in subscription documentations as follows:

a) Agreement on issuance and redemption of units of qualified investors fund;

b) Request for the issuance of investment certificates;

c) Affidavit of the Investor of the Qualified Investors Fund;

d) AML documentation;

e) Questionnaire regarding investment skills.

The Central Register records all registered securities issued in the Czech Republic, including that of Nova Real Estate Fund. The Central Register is a two-stage register composed of a register kept by the Central Securities Depository and the follow-up records maintained by the so-called CSD Prague participants, i.e. especially securities trading participants.

On the base on above mentioned please take into account that we are able to settle the transaction only if your client has so called asset account with one of the Central Securities Depository Prague participants.

See list of Participants here:

Monthly.

There is no deadline, really. A subscription order may be submitted in person at the Investment Company, send via mail (info@redsidefunds.com) or via fax (+420 224 931 368). Shares of the Fund are subscribed for the actual value of share announced always for the period, in which the so-called decisive date occurs, that is the day for subscription of financial means remitted by the fund-holder to the account of the Fund.

The actual value of the unit is determined always as of the last day of the calendar month with validity for the following period, i.e. for September 2016 from the first date of September until the last date of the month. The actual value of the unit of the Fund is determined within 10 business days of the following month, in our example October (upon monthly financial review, as prescribed by the regulator). The actual value of the unit of the Fund is announced within next 15 business days thenafter.

As far as redemption goes, it is always handled with regard to the overall investment. Every investment is redeemed in short period, during days. Greater investments than can jeopardize liquidity of the Fund can take up to one year. Once redemption notice is received, the investment is frozen with zero return until redemption.

If a bank/financial institution is the final client, there is a minimum requirement of 125,000 EUR on an investment. If a private individual invests personally, the minimum investment is 40,000 EUR.

The settlement can be without money or versus money. All we need to agree is the volume to notify the Central Securities Depository that ensures a subscription. It should take longer than a few days, max 10 working days according to the Sub-fund Statutes.

There is no lock-up period and exit fees are charged according to the statute of the fund.

Yes, it is set up for IRR greater than 6%. The performance fee is calculated annually as 30% from the amount of financial means generated by the Fund after taxation in the excess of IRR 6%. Maximum total expense ratio of the Fund including any other costs shall not exceed 1.95 % of the average annual value of the equity capital of the Fund. The temporary internal rate of return - IRR is annually calculated by the same expert who prepared the expert valuation required by law and is audited by the fund auditor.

The performance of the Fund and its return are calculated monthly and the respective financial statements are produced to that effect. No less than once a year every asset in the Fund is revalued by a valuation expert.

The investment strategy is based on investments in special purpose vehicles (SPV) holding the real estate assets. Therefore, the Fund buys various types of assets—retail, offices, industrial—to gradually diversify its portfolio.

As a peripheral type of investments, the Fund will make investments using investment instruments in both the domestic financial market and foreign financial markets, i.e. corporate bonds, corporate bills of exchange, etc.

4

In this case, it is necessary to apply for Redside’s approval because we, as the fund manager, must ensure that the fund’s units are held only by qualified investors (the Czech law must-have condition).

Subscription /redemption and switch notices can be sent every workday till 5 p.m.

EUR 40,000 or EUR equivalent of CZK 1,000,000 if the investor proves awareness of investment skills by completing the investor profile questionnaire. In other cases, the minimum is set at EUR 125,000.

250,000 CZK.

+420 224 931 368

Trading via swift is not allowed.

From the 10th workday in a month.

Amount

Quantity

CZK account: IBAN CZ5727000000002112088894

EUR account: IBAN CZ9427000000002112088907

UniCredit Bank Czech Republic and Slovakia, a.s.

BACX CZ PP