NOVA Green Energy - Subfund 2

NOVA Green Energy - Subfund 2A giant mass of floating plastic in the Atlantic, extinction of animal species, polluted environment, reduced drinking water supplies, the devastation of rain forests in Amazon, high CO2 levels in the atmosphere around the world… There are many global problems facing our planet. What can be done to help the environment? The change starts with you! At NOVA Green Energy, we believe that by supporting meaningful local green projects we can contribute to sustainable development and thus do our part to save the Earth.

NOVA Green Energy contributes to sustainable development in the Czech Republic, Slovakia, and Hungary, in other words, in locations we know. Fund owns renewable energy sources producing green electricity and heat and aims to reduce the negative impact on the environment as much as possible.

That is why we install solar panels where nothing can grow, in the tailings pond near the uranium mine. That is why we use the roof-tops of farm buildings, which have no other use. That is why we try to process all the wood to zero waste. And that is why we use feedstock in biogas stations twice, first as fuel, then as fertilizer.

It is important to us that we do not occupy valuable agricultural land, that we do not affect the surrounding landscape with our projects, and for us to use resources efficiently. Thanks to investors who share those values with us, we can contribute to sustainable development and reduce harmful emissions in the closest environs of Central and Eastern Europe.

The NOVA Green Energy fund is suitable for conservative investors who expect stable growth of their investments and appreciate the net average return over 6 % p.a., which is independent from capital market development.

NOVA Green Energy is a fund of qualified investors (hereinafter only “Fund”) investing in equity of companies operating small and medium facilities (1-4 MW) that generate power from renewable sources of energy in the Central and Eastern Europe, particularly in the Czech Republic and Slovakia. The yield of the Fund is steady because it’s based on feed-in tariffs of electricity for a period of 15 – 20 years; moreover these prices exceed a common market electricity price. Those factors together with effective asset management reflect in economic result of the Fund.

The Fund aims to be the best option for conservative investors expecting stable and adequate capital appreciation in the area of renewable sources. Strict regulation framework, clearly set management motivation, a respected fund manager, expert and auditor as well as other institutional and project guarantees ensure maximum transparency of NOVA Green Energy following the model of Western Europe investment funds.

ndividual Investors

The investment in the Fund is exclusively intended for persons matching the definition of a qualified investor in compliance with Act No. 240/2013 Coll., on Investment Companies and Investment Funds, therefore it is necessary to invest at least 125,000 EUR (3,500,000 CZK) and sign a Declaration of Risk Awareness concerning this type of investment and including investment experience.

Subsequently, the investor wishing to make investments fill out the following documents with the fund manager:

Institutional Investors, asset managers and similar financial institutions

You will need to fill out a few subscription documents:

We will need hard copies of these documents from you by mail. To accelerate the process, please send us scan copies by e-mail while the hard copies are delivered to us.

Why to invest into the Fund?

• Stable and predictable return profile

• Low/no correlation to financial market volatility

• Strong service level agreements with reputable parties

• Proven team and track record

The fund provides an opportunity anchored in legislation-protected investment environment, suitable for cautious investors looking for stable returns.

The fund issues investment shares as no-par value shares. The redemption of investment shares is ongoing throughout the year process and the redemption periods by the investment company are set according to the size of required redemption amount. In case of the investment up to 10 million CZK, 4 months is a maximum period from the end of the month in which the investment company received the request for redemption. In the period starting from the delivery of the request until the redemption of investment shares, the investment shares do not bear any interest.

The investment into the Fund is not time limited. The minimum recommended investment horizon is 3 years.

The purchase of investment shares by individuals (natural) and legal persons is most often carried out through so called “direct investment”. Direct investment means that the investor sends financial means directly to the Fund’s account maintained by its depository and subsequently investment shares are credited to its asset account maintained by one of the participants of the Central Securities Depository (CSD) at an aliquot value. In case the investor has no property account at its disposal, the services of fund’s manager may be used in terms of account setting and the completion of the entire transaction.

In the first place, any investor interested in investing should read the information available about the Fund and its investment profile.

| Fund type | Qualified investors fund - SICAV |

| Fund focus/objective | Renewable sources of energy ; corporate bonds Private equity in medium-sized companies engaged in business of renewable energy; corporate bonds of prosperous companies |

|

Dividend class ISIN CZK: ISIN EUR: |

CZ0008048519

CZ0008048535 |

| Growth class ISIN CZK: ISIN EUR: |

CZ0008048501 CZ0008048527 |

| Issuance | Monthly |

| Issued security | Investment shares are issued as no-par value shares. |

| Expected annual performance: | 6+% p.a. |

| Minimal investment | Minimum initial investment for every single investor of the Sub-fund amounts to EUR 125,000 or CZK 1,000,000 (equivalent 40,000 EUR) after performing a suitability test under Section 15 ZPKT |

| Recommended investment horizon | 5+ years |

| Entry fee | max. 3% |

| Exit fee | max. 5% (2 years from entry) max. 3% (3rd year from entry) max. 2% (4th year from entry) max. 1% (5th year from entry) 0% (after 5 years) |

| Redemption | Monthly |

| Fund manager | REDSIDE, Fund Management |

| Total annual costs | Max. 1.95% from NAV of the Fund |

| Performance fee | 30% from annual audited yield over 6% |

| Depository | UniCredit Bank |

| Auditor | PriceWaterhouseCoopers Audit |

| Supervisory authority | Czech National Bank |

| Law and accounting system | Czech Republic |

| Taxation | 5% from profit |

The key risks in the field of renewable resources that the Fund faces include technological risk, project implementation risk, and natural risk. All those risks may represent a malfunction of the technology, respectively failure to achieve the expected technical parameters of production, which may result in the inefficiency of equipment production at higher costs. Very important is a specific risk of instability of state energy policy, which may negatively affect the value of the Fund's assets.

Another specific risk is technological risk, as well as the operation risk of sources used in order to produce electricity and heat from renewable sources, which are directly linked to natural conditions that may not be influenced externally. Moreover, natural sources such as annual average wind speed, sunshine or crop yield for biomass production could significantly oscillate. Investments targeted by the Fund, both in the Czech Republic and abroad, are subject to state regulations and any change in law, both in the Czech Republic and in other countries where the Fund invests, may, therefore, change legal relationships applying to the Fund's investments, that may differ significantly from the current situation.

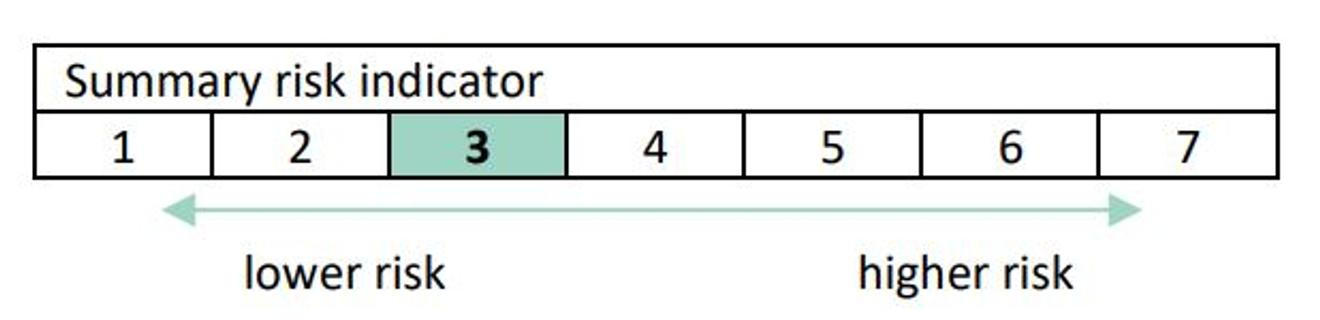

We used available data of comparable investment funds on the Czech market to determine the aggregate risk indicator.

| CZK Growth Share | 1,2517 CZK |

| CZK Dividend Share | 1,1767 CZK |

| EUR Growth Share | 0,1418 EUR |

| EUR Dividend Share | 0,1334 EUR |

| 1 month: | 0,5 % |

| YTD: | -8,22 % |

| Date | Growth Share Price (EUR) | Dividend Share Price (EUR) | Equity Value (EUR) |

| 31.03.2025 | 0,1418 | 0,1334 | 41 584 241 |

| 28.02.2025 | 0,1411 | 0,1327 | 41 334 036 |

| 31.01.2025 | 0,1551 | 0,1459 | 45 309 779 |

| 31.12.2024 | 0,1545 | 0,1453 | 45 123 593 |

| 30.11.2024 | 0,1541 | 0,1449 | 44 929 897 |

| 31.10.2024 | 0,1535 | 0,1444 | 44 725 847 |

| 30.09.2024 | 0,1573 | 0,1479 | 45 938 039 |

| 31.08.2024 | 0,1567 | 0,1474 | 45 883 297 |

| 31.07.2024 | 0,1561 | 0,1469 | 45 465 593 |

| 30.06.2024 | 0,1554 | 0,1462 | 50 998 934 |

| 31.05.2024 | 0,1547 | 0,1455 | 51 057 485 |

| 30.04.2024 | 0,1543 | 0,1452 | 55 021 983 |

| 31.03.2024 | 0,1615 | 0,1519 | 57 418 379 |

| 29.02.2024 | 0,1615 | 0,1519 | 57 356 917 |

| 31.01.2024 | 0,1615 | 0,1519 | 57 842 110 |

| 31.12.2023 | 0,1607 | 0,1512 | 57 736 047 |

| 30.11.2023 | 0,1607 | 0,1512 | 58 211 951 |

| 31.10.2023 | 0,1605 | 0,1510 | 57 850 783 |

| 30.09.2023 | 0,1602 | 0,1507 | 57 967 994 |

| 31.08.2023 | 0,1597 | 0,1502 | 56 545 698 |

| 31.07.2023 | 0,1591 | 0,1496 | 56 498 344 |

| 30.06.2023 | 0,1584 | 0,1490 | 56 456 107 |

| 31.05.2023 | 0,1577 | 0,1483 | 56 193 400 |

| 30.04.2023 | 0,1572 | 0,1478 | 56 269 228 |

| 31.03.2023 | 0,1563 | 0,1470 | 55 959 416 |

| 28.02.2023 | 0,1552 | 0,1460 | 52 046 965 |

| 31.01.2023 | 0,1544 | 0,1452 | 51 470 987 |

| 31.01.2024 | 0,1615 | 0,1519 | 57 842 110 |

| Date | Growth Share Price (CZK) | Dividend Share Price (CZK) | Equity Value (CZK) |

| 31.03.2025 | 1,2517 | 1,1767 | 1 038 150 585 |

| 28.02.2025 | 1,2455 | 1,1709 | 1 034 384 253 |

| 31.01.2025 | 1,3689 | 1,2868 | 1 140 447 138 |

| 31.12.2024 | 1,3636 | 1,2819 | 1 136 437 692 |

| 30.11.2024 | 1,3597 | 1,2782 | 1 135 153 853 |

| 31.10.2024 | 1,3549 | 1,2737 | 1 132 682 078 |

| 30.09.2024 | 1,3881 | 1,3049 | 1 156 719 812 |

| 31.08.2024 | 1,3827 | 1,2999 | 1 148 458 912 |

| 31.07.2024 | 1,3781 | 1,2955 | 1 157 553 992 |

| 30.06.2024 | 1,3719 | 1,2896 | 1 276 503 321 |

| 31.05.2024 | 1,3654 | 1,2836 | 1 261 375 163 |

| 30.04.2024 | 1,3620 | 1,2804 | 1 383 527 770 |

| 31.03.2024 | 1,4253 | 1,3399 | 1 452 972 074 |

| 29.02.2024 | 1,4252 | 1,3397 | 1 454 571 418 |

| 31.01.2024 | 1,4252 | 1,3397 | 1 439 400 910 |

| 31.12.2023 | 1,4184 | 1,3334 | 1 427 523 774 |

| 30.11.2023 | 1,4187 | 1,3337 | 1 413 968 280 |

| 31.10.2023 | 1,4170 | 1,3320 | 1 420 815 232 |

| 30.09.2023 | 1,4141 | 1,3293 | 1 410 940 985 |

| 31.08.2023 | 1,4094 | 1,3249 | 1 361 337 668 |

| 31.07.2023 | 1,4038 | 1,3197 | 1 350 875 414 |

| 30.06.2023 | 1,3979 | 1,3141 | 1 339 703 410 |

| 31.05.2023 | 1,3918 | 1,3084 | 1 334 312 283 |

| 30.04.2023 | 1,3872 | 1,3040 | 1 322 608 206 |

| 31.03.2023 | 1,3791 | 1,2964 | 1 314 486 682 |

| 28.02.2023 | 1,3700 | 1,2879 | 1 222 843 444 |

| 31.01.2023 | 1,3627 | 1,2810 | 1 224 494 783 |

| 31.01.2024 | 1,4252 | 1,3397 | 1 439 400 910 |

The Fund may invest into the following facilities:

Location: Hungary

Installed capacity: 28 MW electric

Commercial operation date: 2021

In fund: 2021

Support scheme: Guaranteed Feed-in-Tariffs for 20 years

Location: Vysočina, Czech Republic

Installed capacity: 4,3 MW electric

Commercial operation date: 2009

In fund: 2015

Support scheme: Guaranteed Feed-in-Tariffs for 20 years

Location: Southern Hungary

Installed capacity: 15 MW electric

Commercial operation date: 2019

In fund: 2020

Support scheme: Guaranteed Feed-in-Tariffs for 25 years

Location: Western Slovakia

Installed capacity: 0,2 MW + 0,7 MW + 0,4 MW electric

Commercial operation date: 2011/2012

In fund: 2015

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Eastern Slovakia

Installed capacity: 4 MW electric

Commercial operation date: 2011

In fund: 2014

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Olomouc region, Czech Republic

Installed capacity: 1 MW electric

Commercial operation date: 2010

In fund: 2016

Support scheme: Guaranteed Feed-in-Tariffs for 20 years

Location: Eastern Slovakia

Installed capacity: 1 MW electric

Commercial operation date: 2011

In fund: 2014

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Eastern Slovakia

Installed capacity: 1 MW electric

Commercial operation date: 2011

In fund: 2014

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Eastern Slovakia

Installed capacity: 1 MW electric

Commercial operation date: 2011

In fund: 2014

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Eastern Slovakia

Installed capacity: 1 MW electric

Commercial operation date: 2011

In fund: 2015

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Eastern Slovakia

Installed capacity: 1 MW electric

Commercial operation date: 2011

In fund: 2015

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Eastern Slovakia

Installed capacity: 1 MW electric

Commercial operation date: 2011

In fund: 2015

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Eastern Slovakia

Installed capacity: 0,8 MW electric

Commercial operation date: 2011

In fund: 2015

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Western Slovakia

Installed capacity: 0,8 MW electric

Commercial operation date: 2011

In fund: 2015

Support scheme: Guaranteed Feed-in-Tariffs for 15 years

Location: Western Slovakia

Installed capacity: 0,7 MW electric

Commercial operation date: 2011

In fund: 2015

Support scheme: Guaranteed Feed-in-Tariffs for 15 years